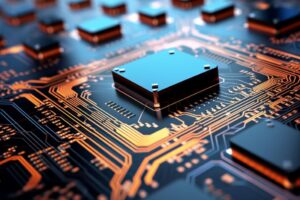

In 2021, the art world was revolutionized by a phenomenon known as NFTs, or nonfungible tokens. NFTs are unique digital assets that exist on a blockchain, a decentralized digital ledger that verifies their authenticity and ownership. Unlike cryptocurrencies such as Bitcoin, which are fungible and can be exchanged on a oneto-one basis, NFTs are indivisible and each one carries distinct information that makes it unique. Essentially, they provide a way to own and trade digital items such as art, music, or virtual real estate in a manner similar to owning a physical collectible. This new form of digital ownership led to a surge of valuations that defied conventional expectations. Artworks that existed solely in the digital realm began fetching tens of thousands, hundreds of thousands, and even millions of dollars, driven by the hype around blockchain technology and the allure of owning exclusive digital pieces.

The NFT Theme

The NFT frenzy didn’t stop at digital art; it extended its reach into the stock market, particularly affecting companies connected to NFTs and blockchain technology. Stocks like HOFV (Hall of Fame Resort & Entertainment Company), FNKO (Funko Inc.), OCG (Oriental Culture Holding), and WKEY (WKHS Inc.) saw astronomical rises in their valuations during this period.

For instance, HOFV’s stock price skyrocketed from around $1.60 in early 2021 to a peak of $12.80, a staggering 700% increase. FNKO, known for its collectible figures, surged from about $11 to $22, marking a 100% gain. OCG’s stock soared from approximately $2.50 to $16, translating to an incredible 540% rise. Meanwhile, WKEY’s price jumped from around $4 to $22, reflecting a remarkable 450% increase.

These dramatic price increases were fueled by the broader resurgence of Bitcoin and blockchain technologies, which generated intense interest and investment. As the NFT craze expanded, the demand for related stocks surged, leading to exceptional gains for those who were attuned to the trend.

This period illustrates a crucial investment lesson: recognizing and acting on emerging trends can be incredibly lucrative. While the NFT hype might have seemed ephemeral, those who took the moment to ask, “What stocks are related to NFTs?” and conducted a simple search, one could have found any of the above mentioned stocks. Investing in these stocks at the right time could have yielded impressive returns.

Ultimately, this episode underscores how the difference between capitalizing on a major opportunity and missing out often comes down to a single moment of insight. In the fastevolving world of finance and technology, taking the time to pause, reflect, and act on emerging trends can make all the difference.